County reports $1.2 million received from 2024 tourism accommodation tax

Administrator | May 26, 2025 | Comments 4

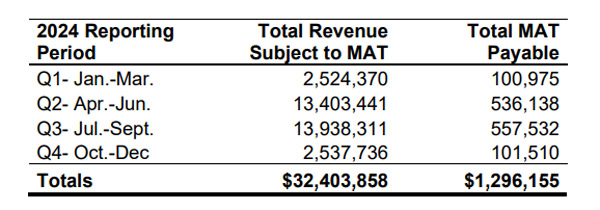

As a new tourism season gets underway, County staff report collecting more than $1.2 million in Municipal Accommodation Tax (MAT) revenue for 2024.

In her report for Tuesday night’s council meeting, Rebecca Carter, Financial Services Supervisor, states that after administrative costs, $1,255,458 was divided between the municipality (50 per cent), StayPEC (formerly the Prince Edward County Accommodation Association), and Visit the County (the municipality’s Destination Marketing Organization), in accordance with each organization’s agreements with the municipality.

Of the municipality’s $627,729 share, it will allocate $110,000 to the Tourism Management Plan, and $517,729 to the Reserve for MAT.

During the 2025 budget deliberations, council decided to limit MAT spending for the year and not to draw from the reserve for other purposes.

As a result, three projects were approved for inclusion in this year’s tourism management plan (which supports summer service – bylaw, parks, outdoor staffing, and supplies and special projects). They include $30,000 to fund the service agreement with U-Ride; $30,000 to continue having portable toilets in parks and boat launches, and $50,000 for the PEC Art Fund. Staff were also directed to return to council with a plan to allocate a further $116,500 through the 2025 Tourism Management Plan.

The 2024 budget saw $419,000 go toward road construction and $118,000 to the 2024 Tourism Management Plan.

In 2023, MAT generated $1,568,466 from an average of 730 accommodators. The 2023 budget allocated $700,000 to roads construction and $118,000 to the Tourism Management Plan.

The MAT generated $1.3 million in 2022 with 902 accommodators listed. The budget allocated $220,000 to roads.

The municipality currently shows it has 850 short-term accommodations (STA) allowed to operate in the County.

The County implemented the four per cent surcharge in 2021 on nightly stays, (roofed accommodations with guests staying for less than 30 consecutive days) that is collected by STA owners, bed and breakfasts, and hoteliers.

MAT rules are governed by the province which states half of the funds collected after administration costs must be shared with a destination marketing program, or board. The other half the municipality may use for infrastructure or services that support tourism.

Starting this year, Carter’s report notes, MAT related project requests will follow a standardized intake process and be integrated into the annual budget cycle.

In addition, she notes the finance department recently signed on with HAMARI, an existing software platform used by Short-Term Accommodation bylaw enforcement staff to ensure accurate data flow, improve compliance and simplify remittance for accommodation providers.

“Additionally, as per a motion of council, the Community Services, Programs & Initiatives department will be undertaking public consultation to gather input on the types of tourism-related projects residents and visitors would like MAT revenues to support” ahead of the 2026 budget deliberations.

Council meets Tuesday at 7 p.m.

Filed Under: Featured Articles • Local News

About the Author:

Another sore point – developers/property owners that have been going through the Planning Dept. and our Council, requesting (and receiving) various amendments, should not be allowed to sell it on to someone else without finishing what they started. This is also another “grandfathering” scheme that some developers appear to use – get all their “ducks in a row”, then sell it on to the highest bidder. The residents who went through the consultation/planning processes, and in many cases were pushed into accepting those amendments, then have to tackle someone new, who now have their own idea of what the amendments should be. It is all painstakingly difficult and awkward to follow all the steps required through Shire Hall. The new owners should be required to start from the beginning as well. I’m also tired of being given only a numbered company for a name, or the new name of the project, and not being told who the real person is behind the various projects. It is difficult if not downright impossible to find out what other projects that company has worked on, or even completed. Some don’t really finish a project – just sell it on once the paperwork is done.

Clearly the County no longer needs to do any advertising for tourism. The events that are put on advertised through their budget. We are established as a go to destination.

Tourists need things to do places to go oh wait garbage to make!

Why isn’t part of those funds paying for Business garbage pick up?

The affordable housing crisis was created by allowing such a large number of units to function as STAs. It’s time to further reduce the number of STA licences available. Equally important is eliminating the grandfathering of licences. Once a STA property is sold the license should expire and not be treated as a commodity that automatically stays with the property.

I would recommend, ahead of this meeting, reading 11. Items for Consideration in the Agenda, for more details:

https://princeedwardcounty.civicweb.net/Portal/MeetingInformation.aspx?Org=Cal&Id=3300