County budget balancing challenge begins

Administrator | Dec 05, 2023 | Comments 4

At Monday night’s opening session of budget week talks, council heard several people speak about dire needs for services throughout the County, but also heard concerns that taxpayers have no more money to give.

The ball is now in council’s court this week to balance wants and needs as they comb through the 2024 proposed budget presented with a starting point 10.7 per cent increase in property tax (12.66 increase before growth).

Approved as presented, residents would be paying an increase of $109.47 per $100,000 of assessed value (a figure decided by MPAC – the Municipal Property Assessment Corporation). A household with an MPAC property assessment of $600,000 would have a tax bill of $6,663 in 2024.

Councillor Brad Nieman suggested staff, who created the proposed budget and know it best, could find cuts to get it below a 10 per cent increase and present that Tuesday as “12.7 per cent is unacceptable.”

The mayor and several councillors answered staff has put its best foot forward following months of work, and it is now the job of council to make the tough decisions.

Mayor Steve Ferguson stated he’s all for cutting costs as much as possible as well, and “that is our (council’s) job as we go through the budget to determine, with staff guidance. There’s a lot of work ahead of us this week.”

“Yes, that’s our job to decide what’s necessary and what’s extra and how much extra we can afford,” added councillor John Hirsch. “I don’t like that 12.7 top number either, and I already have some ideas. We have 355 pages of stuff to go through to knock that number down if we can. But that’s council’s decision – what’s essential, what’s nice to have and how much of that can we do. We proceed and try to take a sharp pencil to it.”

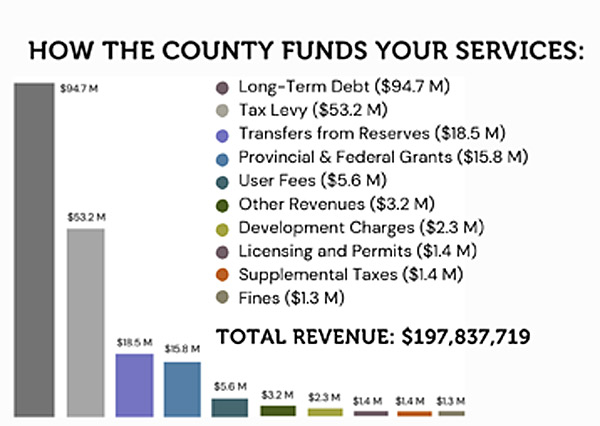

Amanda Carter, Prince Edward County’s Director of Finance, presented council with the overview of the $77.8 million draft operating budget that shows increases driven by dwindling reserves, wages and benefits due to cost of living increases and coming collective agreement negotiations with CUPE and ONA unions; increased requests from external agencies and contracted services, and higher costs for equipment and supplies.

The rate-supported budget covers water and wastewater and is fully funded by users with no financial support from property taxes.

The tax-supported budget is funded by the tax levy, user fees, grants and subsidies.

The operating budget pays for day-to-day operations while the capital budgets are planned investments for reconstruction or major improvements. Council can only make spending decisions for 2024 but may discuss impact for future years.

Beginning Tuesday, Dec. 5 at 9 a.m. an in-depth discussion will take place between council and senior staff about the proposed 2024 budget. The water and wastewater budget is to be presented first. The delivery of services, and infrastructure investments, follows.

The $95-million H.J. McFarland Home reconstruction project – put off last year so the project could be shovel-ready to be able to gain provincial funding for the 160-bed project – is back on the table, as is replacement of the existing roof at $135,000.

Proposed 2024 operating budget of $77.8 million:

– 35.8% ($29.9 million) is for wages and benefits to provide services managed by the County (up $2.0 million from 2023)

– 38.4% ($29.9 million) is for contracted/professional services, equipment, supplies and materials (up $3.5 million from 2023)

– 21.7% ($16.9 million) is for services provided through external agencies and boards (up $1.0 million from 2023)

– 1.4% ($1.1 million) is for long-term debt (down $221,000 from 2023)

Operating budget expenditures offset by non-tax revenues of $24.5 million (up $400,000 from 2023).

Council resumes Tuesday at 9 a.m. The public can attend, or stream it from YouTube.

Filed Under: Local News

About the Author:

Instead of charging the tax payers with the full percentage of increase. Why don’t you charge the tourist extra money or increase the STA’s licensing fees? It’s more of a tourist town anyway. Plus, extra charges for the subdivisions that are adding an increase on all our expenses. The County is looking more like a city. It’s no longer a quiet place to be anymore.

Taxpayers will be on the hook if all promises for the future fail to materialize. As a life-long taxpayer, I never asked or agreed with accumulating almost 100M in debt, nor do I agree we should spend more.

Why do successive councils try so hard to make the county something it isn’t? It was just fine as it was. And that’s not meant to be a slight against folks who come from away. There are plenty of fine people who settled here who also thought it was perfect the way it was too. Stop the madness.

The budget figures in this article, if accurate, are a bit perplexing. The operating budget allocations total only 97.3%. Is the other 2.7%, or $2.1 million, for matters so essential they can’t even be examined?

I also notice that most budget categories have either increased less than 10% or even declined. Wages and benefits are up 6.2%, and services provided by external agencies and boards, 7.2%. Long-term debt servicing, astonishingly, is down 16.7%.

The exception, which appears to be causing the ridiculously high budget, is contracted professional services, equipment, supplies and materials, up 13.3%. I assume this budget category includes consultants.

Perhaps council could reduce the 2024 budget by less hiring of expert opinion and by more reliance on collective (community?) judgment and wisdom.

First lets look at doing more with less like the private sector does, smaller management and less frills.