‘Significant’ off-season demand needed for accommodation providers in the County

Administrator | Mar 12, 2018 | Comments 0

A 50-room unbranded inn with conference facilities, or a 60-unit limited service hotel in Picton, Wellington or Consecon have been identified as possible development prospects in the County. To fight the challenge current accommodation providers have – slow business outside of tourist time – they need “significant new corporate or off-peak leisure demand” in the County.

The ‘Accommodation needs assessment report’ is before the Community and Economic Development Commission members Monday afternoon. The County’s Community Development Department is presenting the report along with ideas to support year-round visits. Targeted promotions to Francophones, the LGBTQ community, cyclists, family-friendly assets, an inventory of winter-specific activities are proposed along with promoting PEC as a premier event and wedding destination and a key stop for nature enthusiasts, as well as continued promotion throughout the ‘Golden Triangle’.

The commission requested the study last year seeking to serve a greater variety of travellers, including families and sports teams, capturing revenue and potential spending being lost to nearby communities due to a lack of suitable overnight accommodations. The information is also intended to assist potential developers to determine feasibility of building in the County.

The County’s ‘corporate strategic plan’ states investment and development in visitor accommodations could help slow the current rate of vacation rental conversion and investor speculation in single family dwellings as income properties. It also hopes development could bring more full-time equivalent employment.

CBRE Limited, of Toronto, received the $15,000 contract to collect data about the industry, identify needs and potential opportunities. Its clients include major hotel brands as well as companies and individuals within the hotel investment and lending community.

The CBRE report states that overall, the proposed accommodation developments may not meet traditional hotel investor and developer performance criteria but “interest and potential for future accommodation growth lies in significant new corporate or off-peak leisure demand, and with investors that are interested in a more unique investment opportunity.”

Based on stakeholder feedback, CBRE noted the event and corporate retreat market represents a significant opportunity for new accommodation within Prince Edward County.

“The segmentation of demand for Prince Edward County differs from the overall regional market and is comprised primarily of leisure demand (78 per cent), with some meeting/conference demand (16 per cent), and only a small amount of government/other and corporate demand (a combined 7 per cent).”

Finding accommodations for guests is reported as the number one challenge for tour operators that bring, or facilitate tour business here.

“There is a lack of sufficient meeting space with on-site accommodations capable of hosting larger groups for both on-site multi-day meetings or events,” the report states.

Capital costs to construct an inn, or unbranded hotel, would be in the $9 to $10 million range.

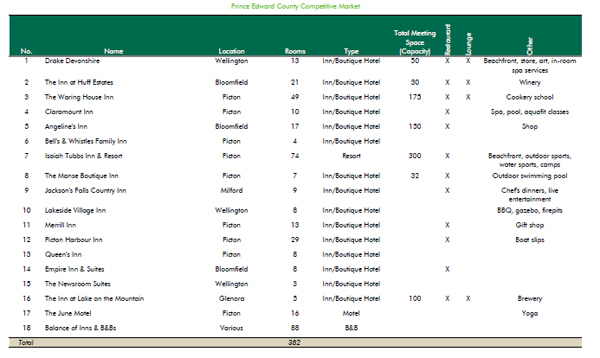

The report tallies 14 primary venues in Prince Edward County currently being used for larger scale social events and corporate meetings. Inventory data showed approximately 80 bed and breakfast establishments in the County open seasonally. The report’s competitive market analysis focused on 52, representing 156 rooms and 32,120 room nights for the season equating to an average of 88 rooms available per day on an annualized basis.

There are three professional vacation rental companies here that each manage between 50 and 90 properties. The report noted 580 active Airbnb listings and 79 per cent of active listings as entire homes.

“In 2016, events hosted in the County generated an estimated 475 event days (including multi-day events), and 33,700 attendees, for an average of 71 visitors per event, and approximately 9,100 potential room nights for fixed roof accommodations. Weddings and other social events generate a significant level of accommodation demand within Prince Edward County and the surrounding area.

The report also notes unaccommodated demand for corporate retreats and for numerous sports teams and associations that currently make use of County facilities.

Either proposed development is projected to achieve strong occupany levels in the summer, strong weekend occupancies in the spring and fall but mid-week occupancy in off-peak periods “will present a significant challenge in achieving sustainable business levels.”

The average daily rate for a hotel is projected to be $230 in the first year of operations, increasing to $239 by Year 3 – with occupancy rates over a calendar year between 50-60 per cent. The hotel’s rate positioning is predicated on the hotel being developed as a mid-to-upscale inn property with on-site amenities and services.

“When evaluating the top line or “occupancy” performance of an accommodation facility, operators will most often look for projects with expected annual occupancy at or above 70 per cent,” the report states. “Occupancy results at this level provide a clear indication that the property will reasonably be able to capture an adequate number of occupied room nights year-round.”

The report states that in 2016, the Prince Edward County accommodation market achieved approximately 51 per cent occupancy with an average daily rate of about $172.

Peak demand is in July and August, with a slightly softer demand in the shoulder periods. Winter, early spring and late fall periods experience the lowest levels of demand, with occupancies falling between 25 to 35 per cent and the average daily rate reduced by as much as 50 per cent.

Filed Under: Local News

About the Author: