County outlines proposed short-term accommodations licensing

Administrator | Apr 17, 2019 | Comments 12

Story and photos by Sharon Harrison

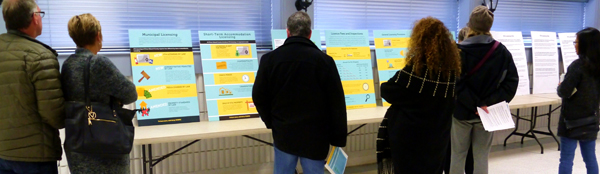

The next step in the contentious issue of regulating short-term accommodations (STAs) was outlined at a public open house Tuesday evening.

It was a packed house at the Prince Edward Community Centre as the municipality presented its proposed new bylaws, amended bylaws, and licensing fee structure and fines, before a crowd of several hundred residents.

Neil Carbone, director of community development with the municipality, went step-by-step through proposed changes. County staff were also on hand to answer questions.

“The purpose of tonight’s meeting was to provide some context and really touch on the some of the important points of the proposed licensing,” said Carbone.

He outlined the history to date on the changes to regulations surrounding STAs, noting existing regulations which came into effect in October 2018 related to maximum density, identifying specific zones, occupancy limits, parking requirements, etc. and are enforced now.

Tuesday night’s meeting was an initial presentation on the licensing of STAs and the municipality seeks feedback over the next two to three weeks.

Carbone noted the municipality received a lot of questions since last fall, particularly about legal non-conforming status, i.e. pre-existing short-term accommodations.

“Pre-existing legal short-term accommodations are generally considered legal non-conforming, or grandfathered,” said Carbone. “In other words, you would not need to apply for the provisions of those new zoning by-law amendments. However, that said, being a permitted STA (so STA as legal use) means you are eligible to receive a licence, but all STAs still have to obtain a licence.”

To create the proposals around licensing, the municipality held various consultations and meetings with industry experts and informal groups, said Carbone.

“An important difference that was noticed through those consultations was the difference between B&Bs or STAs where there is a primary resident on site, versus a whole-home STA.”

There are to be four bylaws – STA licensing, administrative penalties, an amended fees and charges bylaw and an amended property standards bylaw.

An STA licensing bylaw would set out the licensing program requirements to apply for, and obtain a licence, as well as fees and penalties. An administrative penalties bylaw allows municipalities to charge deterrent penalties, incur no legal costs and can be added to the municipal tax bill if a penalty goes unpaid. The fees and charges bylaw amendments allow the municipality to set licensing fees and charges in accordance with the licensing program. The property standards bylaw amendments update the bylaw to reflect requirements of the licensing program.

There would not be a single licence if you own multiple properties; a separate licence will be required for each.

“Licences would need to be renewed annually,” said Carbone. “Fees would also be levied on a per-guest room basis, so not a flat fee for all STAs depending on the type. If you have one guest room in your STA, you pay the fee for one guest room; if you have four, you pay the fee for four guest rooms.”

There will be two types of licences: one for primary residences, such as a B&B where there is a resident on site. A second type of licence will be issued for a whole-home, or a non-owner occupied STA.

Licensing does require inspections, but we don’t want those to be too onerous, he said.

“We are proposing every two years for an inspection of a whole-home STA, and every four years for a primary residence STA, such as a B&B. In the non-inspection years, you will be expected to provide a sworn affidavit with some additional paperwork saying that nothing has changed with the STA since you applied for that licence.”

The fee for a primary residence STA licence (such as a B&B) is lower. Additionally, in non-inspection years for both types of STAs, a 50 per cent fee reduction is proposed.

All licence fees are non-refundable, and licences are valid for one year from the date of issuance.

Carbone said they had received a lot of questions about transferable licences, but confirmed that all licenses will be non-transferable.

“However, a property with legal non-conforming status does not lose that status if the property is sold,” said Carbone. “If you are legal non-conforming, you are grandfathered in, and if you sell that property the next owner is still eligible to apply for a licence.”

According to the Municipalities Act, municipalities cannot profit from licensing.

“We cannot charge more than it costs to administer the program,” he said. “The program revenues must support only the costs of running the program, and they can’t be redirected to some other activity, such as filling pot holes, etc.”

The municipality has estimated there will be 900 licences. Of those, approximately 20 per cent are B&Bs (primary residence STAs), which amounts to 403 guest rooms. The balance (80 per cent) are whole-home STAs.

“This amounts to roughly 2,100 guest rooms,” said Carbone. “A total guest room count is about 2,500-2,900.”

Carbone said there will be no cap of the number of licences given out, noting the idea is not to prevent STAs, but to present measures to control them.

In terms of human resources, the municipality expects to require a dedicated admin clerk, and three building and bylaw inspectors to administer the 900 licences initially. In addition, there are anticipated costs of $25,000 for software and vehicle costs of $105,000.

It will cost the municipality $550,000 annually to operate the licensing program.

The licensing fees are proposed, as follows:

Primary residence (in an inspection year) – $200 per bedroom

Primary residence (in a renewal year) – $100 per bedroom

Whole home residence (in an inspection year) – $300 per bedroom

Whole home residence (in a renewal year) – $150 per bedroom.

“Depending the size of the STA, a primary residence in an inspection year, a three-bedroom B&B, would be a $600 licence fee, and those next three renewal years would be a $300 licence fee.”

“For a whole home STA with four bedrooms, in an inspection year, would be $1,200 licence fee, and in every second year, the renewal year, it would be a $600 licence fee.”

The application requirements will need to identify some basic information, including the civic address of the STA, the number of guest rooms, the registered owner, contact information, any other STA numbers, copies of advertisements of the property and a photo of the front of the property.

A site drawing will also need to be submitted to show the floor plan, location of building and setbacks, dimensions, etc.

“Importantly, there will need to be proof of insurance, but the County is not proposing a requirement for commercial general liability insurance,” said Carbone. “General liability insurance is sufficient, providing that it covers the use of your property for short-term accommodations.”

Other basic requirements include making a copy of the licence available, making a copy of the floor plan and fire escape route available. The parking requirements must be listed together with a copy of the noise bylaw.

Carbone noted that STA owners can’t be in arrears on property taxes and water bills to apply for a licence.

Licences can be refused (or revoked) if false information is provided, or if there is a history of contraventions, a breach of bylaws or regulations or a refusal to comply.

Carbone spoke to the infractions and penalties, saying there were small fines, right up to larger sums. “These will increase with each infraction,” he said. “For more significant infractions, the fines are larger and if those issues are not rectified, they can double and they can add up.”

Penalties for first time offences range from $100-$1,000. Fines for repeat offences can reach $4,000, and Carbone noted for very serious offences, fines can be up to $100,000.

If the program is approved, the municipality expects to be able to accept applications this summer. There will also be a grace period until the end of the year.

“Beginning Jan. 1, 2020, enforcement of new bylaws would start,” said Carbone.

Questions and comments ranged from concerns about front-end loading of fees, noise bylaws, water testing, the definition of owner-occupied, insurance, what constitutes a sale or change of ownership, to the definition of a bedroom and concern about dark communities, especially in Bloomfield and Wellington.

A spokesman representing a group of about 20 members from the B&B Association of Prince Edward County had a number of comments and questions

Carbone said feedback, comments and questions are welcome in the next two to three weeks. A Special Committee of the Whole meeting will be held in May where council will consider the licensing proposal. Council could then ratify the proposal in late May or early June.

Presentation materials and all related materials will be available on the municipality’s website from Wednesday.

Filed Under: Featured Articles

About the Author:

I smell a rat. This tax will never be paid through fees collected.Tax payers are underwriting this and covering any

(HA,HA) losses.

Once the new employees are hired,and expenses are greater than fees collected, there will be no changes to budget or staffing for fear that “next year” we will be under staffed.

There should be no grandfather clauses.That only sets up a two tier system and confusion.

This chaos has happened by the failure of The County to:

1. attract new investment by hotel/ motel owners.

2.tax increases ,outstripping inflation rate by 3x,causing home owners to find other income sources.

3.100% reliance on tourism and agriculture as the only generator of economic activity.

The inability of The County Economic Development arm to

create year round employment to any degree has been the greatest failure of amalgamation.

Any one remember the promise of “The Creative Rural Economy”? Millions of dollars wasted. 90% of the people who came to live and work here as self employed business owners would have come here any way.

This is headed to more beauracracy and cost to taxpayers. STA controls will do nothing for affordable housing in fact may hurt it by raising out of control taxation.

Please be sure to forward any opinions you have on this extremely important issue to communications@peccounty.ca.on so that they are taken into consideration as this issue moves forward.

And if licensing revenue does not meet our taxpayer increased staffing and vehicle costs, then what? Where is the revenue – cost neutral plan moving forwaard?

The kiss program – KEEP IT SIMPLE STUPID. Vancouver solved the problem straight forward. You must live in building to rent out daily rental. How hard is it to do this.

The new regulations are intended to ensure the safety and comfort of guests, quiet enjoyment by neighbours and limits on “dark streets”, helping to ensure that tourism doesn’t overwhelm the County lifestyle. The costs of monitoring and enforcement will be paid by the landlords, not by taxpayers.

Like you said – these are proposed changes. Now is the time to give feedback if you want to change how this is being done. Don’t get railroaded by Shire Hall – speak up and make your voice heard.

I truly hope that these PROPOSED changes meet with plenty of feedback so the County realizes what they are up against. I think it’s fair to say that many folks would never be in the STA business if they had a viable means of paying their taxes and water bills. These figures are inflated and won’t do a bit of good to benefit anyone. Go back and consider the real cause of this issue, and then determine who would benefit and who would be punished under these proposed changes. Can this County ever get anything right?

More employees, more taxation and more regulation on personal property. And how does the end result of this improve the County?

550K and continue to build the taxpayer employee count. I knew this would turn into more jobs and vehicles and regulation of private property owners.

I feel that non-owner occupied houses, used solely for STA, should NOT be grandfathered for continued use for this purpose if they are subsequently sold. These regulations are simply allowing usage that is now widespread but was never intended.

Residential homes and part or whole neighbourhoods were never supposed to be converted for commercial use. Current owners will not be penalized when they sell these homes but neighbourhoods will, over time, return to some semblance of “normal” and much-needed full-time, permanent housing stock will again be available.

You have to be kidding us!!! $550,000. to increase staff and administration in an already bloated municipal corporation. After the largest tax increase in the history of Prince Edward County of 8.62%, you are finding new ways to tax many who are trying to find a way to pay the taxes they are already burdened with? Saying the licences will pay for the additional costs, does not make it right. This empire building with unending, and unnecessary spending needs to stop.Is Rick Conroy the only person to see and say anything about this. For the sake of the County, Council members, get control of this.